INTERNAL AUDIT

An effective internal audit is concerned with evaluating and improving the effectiveness of risk management, control and governance processes in an organization. Organizations are increasingly leveraging internal audit as a strategic resource, recognizing that internal auditors’ broad and deep perspective of operations, risks and potential opportunities can help inform business decision-making. All organisations are subject to fraud risks and there have been several instances when frauds have disgraced organisations as a whole.

With increased regulatory focus and widespread negative impact of frauds, the managements and senior executives are increasingly concerned about the vulnerability and exposure of their businesses/ organisations to frauds and whether or not they are adequately protected. This emphasizes the need of internal audit in fraud risk management.

Mandatory Requirement For Internal Audit In India

Section 138 of the Act was enforced with effect from 1st April 2014. As per section 138 of the Companies Act, 2013, such class or classes of companies as may be prescribed shall be required to appoint an internal auditor to conduct internal audit functions and activities of the company. Accordingly such class or classes of companies have been prescribed in Companies (Accounts) Rules, 2014 by Ministry of Corporate Affairs. The following class of companies shall be required to appoint an internal auditor namely ,- Listed companies : – Appointment of an internal auditor is mandatory

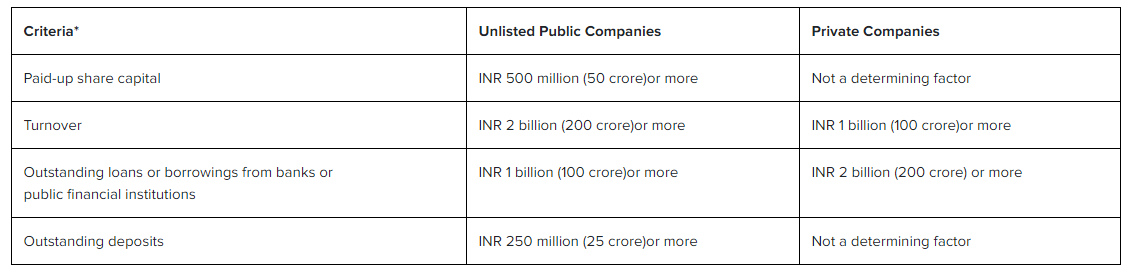

- Unlisted public company and private companies : – Appointment of an internal auditor is mandatory if either of the following criteria are met

However, a company can also on sole discretion opt for internal audit even if it does not qualify for the mandatory requirements due to several benefits stated above.

Our audit methodology includes making recommendations for improvement, not just to express numbers and ensure compliances. The recommendations are realistic because we want you to implement them. We also ensure our clients are updated all around the year of accounting, financial and regulatory developments that may impact their business. Working in the capacity of an internal auditor, we provide following services:

- Risk Assessment and development of risk based audit plan;

- Evaluating the adequacy of the system of internal controls;

- Recommend improvements in controls;

- Assess compliance with policies and procedures and sound business practices;

- Assess and ensure compliance with legal and contractual obligations.

- Review operations/programs to ascertain whether results are consistent with established objectives and whether the operations/programs are being carried out as planned.

About Us

We are a team of proficient and dedicated chartered accountants based in New Delhi as well as other major cities in India. We typically handle all the branches of accounting and auditing including accounts outsourcing, Business taxation, corporate compliance, company formation in India, starting a business in India, registration of foreign companies, taxation of expatriates, etc.

contact info

- New Delhi

- Jammu & Kashmir

- Uttar Pradesh

- Maharashtra

- Karnataka